A Zero Budget And Empty Rhetoric for Farmers Vijoo Krishnan

In a year when about half the country is reeling under severe drought, the least that was expected of the Union Budget was that there will be certain steps to provide succour and confidence to the distressed peasantry. The Budget has nothing concrete for farmers and is merely empty rhetoric. It does not address the issue remunerative prices for farmers’ produce or suggest any steps to free them from indebtedness. It has come as a big disappointment to the peasantry and is tailor-made to boost corporate profits at the expense of the cultivators.

According to the Economic Survey the Inter-Ministerial Committee to examine issues relating to Doubling of Farmers’ Income (DFI) and recommend strategies identified seven sources of income to double farmers’ income by 2022 namely improvement in crop productivity; improvement in livestock productivity; resource use efficiency or savings in the cost of production; increase in the cropping intensity; diversification towards high value crops; improvement in real prices received by farmers; and shift from farm to non-farm occupations. Lower growth in agriculture and allied sectors has also been noted in the Economic Survey. It also noted that total food grain production during 2018-19 fell to 283.4 million tonnes from 285 million tonnes in 2017-18 and in a drought year the downward trend is likely to continue as prices are also not looking up. Nothing has been done turnaround the situation. There is nothing done for improvement in real prices received by the farmers, for savings in the cost of production. The policy prescriptions are in the direction of withdrawal of State from investment in agriculture and rural development coupled with deregulation and opening up of the economy. The BJP Manifesto in 2014 had stated “Agriculture is the engine of India’s economic growth and the largest employer and the BJP commits highest priority to agricultural growth, increase in farmers’ income and rural development.” The Economic Survey however, talks of private investment as the key driver of growth shirking off the responsibilities of the Government and public investment.

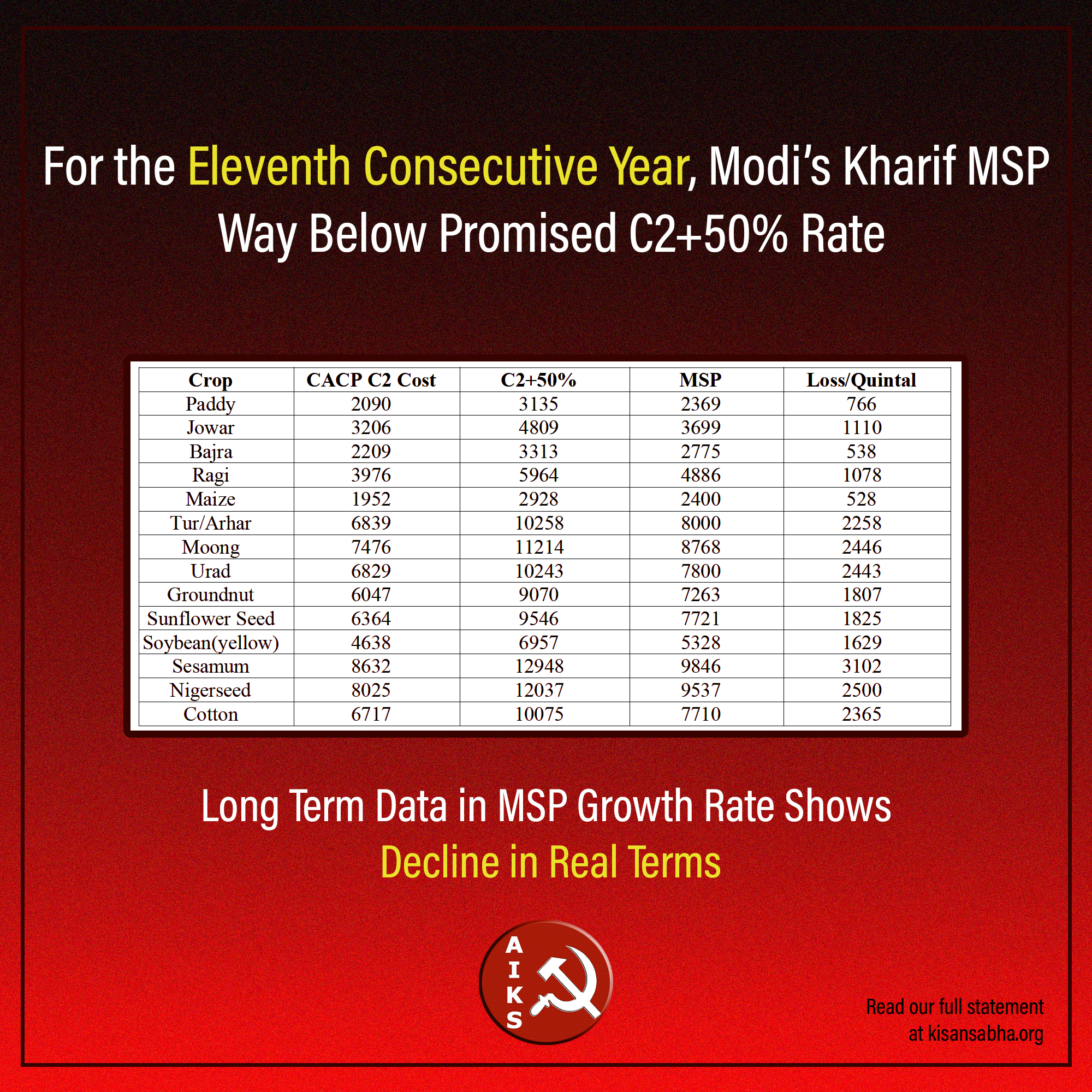

What lay in store for the distressed peasantry in the Budget 2019-20 was clear from the tone and tenor of the Economic Survey, Niti Ayog and the announcement of Minimum Support Prices (MSP) of Kharif crops just before the Budget. Immediately preceding the Budget, the BJP Government announced the MSP of Kharif crops for 2019-20 marketing season which finally consigned to ashes the Swaminathan Commission recommendation of fixing MSP at least 50 per cent above the comprehensive cost of production C2+50%. There has merely been a hike in floor price of Kharif crops ranging from 1-9 per cent over last year. It has announced a meagre 3.7 per cent hike in the prices of paddy despite the fact that costs of production over the year have drastically increased. This will only mean an increase of Rs.65/Quintal. It is notable here that the Commission on Agricultural Costs and Prices (CACP) cost calculations are questionable and the weighted average costs are arrived at by making drastic undervaluation and are nowhere near the actual costs. For instance the projected cost for Kharif Marketing Season, 2018-19 for Paddy by the State Government of Punjab was Rs.2490/Qtl while the CACP calculation was only Rs.1174/Qtl; not even 50 per cent of the projected costs put forward by the State Agricultural Department. The C2 costs as per BJP and JD-U ruled Bihar for paddy is Rs.1605/Qtl but CACP considers it as Rs.1398/Qtl only. Odisha State projection is Rs.2344/Qtl while CACP considers it as only Rs.1713/Qtl. This is the case in most crops. Even taking the C2 costs as arrived by the CACP that is Rs.1,560/Qtl the C2+50% would come toRs.2,340/Qtl. But the MSP announced is only Rs.1,815/Quintal. It is also worth noting that the Left Democratic Front Government in Kerala procures paddy at Rs.2,650/Qtl.

The Government has added to the burden of the peasantry by proposing Rs. 2 cess on diesel which will increase the cost of production significantly. The Government is moving in the direction of greater deregulation. This has led to increasing agricultural costs as opposed to savings in cost of production. A major cause of the crisis in agriculture is the huge increase in prices of inputs that has taken place as a result. With a huge rise in the cost of seeds, fertilisers, diesel and electricity as a result of decontrolling of prices of these inputs and imposition of GST, government needed to restore price regulation and bring prices of input costs under control. Instead of controlling prices and providing quality inputs to the cultivators, the Government prescription is for further deregulating and allowing the corporate agribusinesses to fix farm gate prices to profiteer at the expense of the farmers. All talk of Doubling Farmers’ Income is pure propaganda while in reality the Government policies are only doubling the woes of the farmers.

The Budget also has no steps to free the distressed peasantry from indebtedness. The Economic Survey ironically invokes some obnoxious “pious obligation doctrine” to make people pay debts. It points out as to how in Hinduism non-payment of debts is a sin and the souls of those who die in a state of indebtedness will face evil consequences; according to Islam a person cannot enter paradise until debt was paid off and according to the Bible only the wicked borrows and does not repay. It however, does not say what would befall policy makers whose prescriptions lead people into a state of perpetual indebtedness. What greater insensitivity than this?

Extreme drought conditions have led to footloose migration in search of livelihood pushing millions into extreme insecure existence in the urban landscape. The Budget was expected to substantially enhance the allocation for MGNREGA to generate employment in the rural areas and provide work as well as food for the large army of unemployed labour in search of work. The Budget rather does exactly the opposite. It has cut the allocation for MGNREGA by more than a thousand crores as compared to the revised estimates for last year. This is in a situation wherein the allocation in the last Budget itself fell way below what was required to effectively implement the programme and provide at least 100 days of work in a year.

The allocation for Market Intervention Scheme and Price Support is grossly inadequate for meeting the requirements of procurement. Also, since the government has introduced schemes such as Price Differential Payment the benefit of which goes to traders rather than to farmers, it is not clear how much of the Rs.1000 crore additional allocation will be used for procurement. This is particularly important in the context that very little increase in MSP has been announced two days back for Kharif 2019. It also talks of promoting Israeli model in irrigation which is also a vehicle into Indian countryside for Israeli companies like Netafim with dubious records on Palestinian rights.

The Budget speech claims that the government will invest widely in agriculture infrastructure, support private entrepreneurship for value addition in farm sector and Pradhan Mantri Matsya Sampada Yojana to address critical infrastructure gap in fisheries sector. In the name of modernisation, the sector would be opened up for corporate fishing companies. While there is talk of promoting dairy sector, the Government is also fast tracking the Mega FTA RCEP which will be the death knell of dairy farmers. The mention of starting 10,000 Farmer Producer Organisations and support for private entrepreneurship does not talk of peasant cooperatives. There is talk of increased emphasis on contract farming. The move is to facilitate direct procurement by big retailers and promote FDI in all sectors including retail.

Unfortunately, even in times of severe drought, the Government is not forthcoming in providing relief to States. According to RTI data even the much advertised flagship programme of the BJP Government namely the Pradhan Mantri Fasal Bima Yojana has miserably failed in times of extreme drought adding to the distress of the peasantry. The total premium collected by companies amounted to Rs.20,747 crore the claims paid to farmers was merely Rs.7,966 crore, implying that more than Rs.13,000 crore was pocketed by the insurance companies. Pending insurance claims certified by State Governments that have not been approved by companies for the Kharif season that ended in December, 2018 is Rs.5,171 crore. This is despite the PMFBY guidelines stipulating clearance of dues within two months of the end of harvest or by February, 2019 at least. Nearly 40 per cent of the Rs 12,867 crore estimated claims remained unpaid as of May 10, 2019. Nothing has been done to address such concerns in the Budget. In drought situation such apathy is criminal and required to be rectified.

Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) promising all farmers with landholding of up to 2 hectares Rs.6,000/year is being advertised as a panacea for all ills faced by the farmers. As per the last Agricultural Census, there are about 12 crore households having land holdings below 2 hectares. In reality, the number of families operating less than 2 hectares is likely to be considerably more than 12 crores. A vast majority of cultivators who are tenant farmers and Adivasi cultivators who are not registered in land records are excluded from the scheme. Also, the amount promised to be given to each farmer family is too meagre as it amounts to Rs.500/month or less than Rs.17/day. The hollowness of such Schemes will be clear when we note the difference between this Scheme and the Price Support. The Government is no longer talking about C2+50% and is going to try to wash its hands off public procurement by giving this cash pittance. A farmer cultivating paddy on 2 hectares of land in West Bengal produces up to 9 tonnes at the rate of 4.5 tonnes/hectare. If MSP of Rs.1815/Qtl was assured, the farmer would have received Rs.1,63,350 for the total yield. In most parts of India including West Bengal, farmers are forced to make distress sales at as low as Rs.1000/Qtl because of lack of procurement by government. In such circumstances, the farmer would get only around Rs.90,000 for the total yield which is a loss of Rs.73,350 every year. The loss incurred by farmers is even greater if one compares their revenue with the C2+50% price that they should be getting. Instead of providing remunerative prices and subsidised inputs, Government policies are leading to increased costs of production and stagnation or fall in crop prices. In such circumstances, schemes that promise transfer of amount to farmers have to be seen in light of such huge losses to farmers. It is here that the efforts of the LDF Government in Kerala are receiving attention. The move to procure paddy at Rs.2650/Qtl, would fetch the farmer Rs.2,11,500/- which is Rs.48,150/- more than what the latest MSP would fetch and Rs.1,21,500/- more than what a farmer in most parts of India would get.

Another example is the case of garlic farmers in Madhya Pradesh. The cost of production is Rs.27/Kg according to the State Government while farmers claim it is ranging between Rs.33-35/Kg. The farmers are getting as low as Rs.1/Kg in the Neemuch market. In a hectare the production is around 5600 Kg. The MSP announced is Rs.36/Kg but farmers are not getting any benefit of such announcement. The cost of production even according to conservative Government figures per hectare is Rs.1,51,200. If the MSP was given farmers should have got Rs.2,01,600/- while they are being offered Rs.5,600/-. While this is the nature of losses suffered by farmers every season, one can understand the farcical nature of the PM-KISAN. The Pradhan Mantri Kisan Pension Yojana which aims to cover around 5 crore beneficiaries in the first three years requires them to contribute Rs.1200/- every year till the age of 60 years. The need however, is to ensure a pension for farmers above 60 years with immediate effect and the Government should take the entire responsibility.

Clearly, a Government led by a party that is indebted to the corporates for their funds and were assisted through the electoral bonds is only fulfilling their tasks in accordance with the “pious obligation doctrine” It is all an exercise to ensure their souls rest in peace and a place is reserved for them in paradise when death finally plays the leveler’s role.